Do you still remember the years when the jeepney fare was

just 4 pesos? Or how about enjoying your favorite McDonalds or Jollibee meal for only 25 pesos with the burger and cup of

soft drinks much bigger? How about going

to the grocery store with 1,000 pesos to spend, isn’t it that you were able to

buy much more items many years back than today?

Those were the days when our money can purchase

more. But we cannot go back to those

days but only move forward.

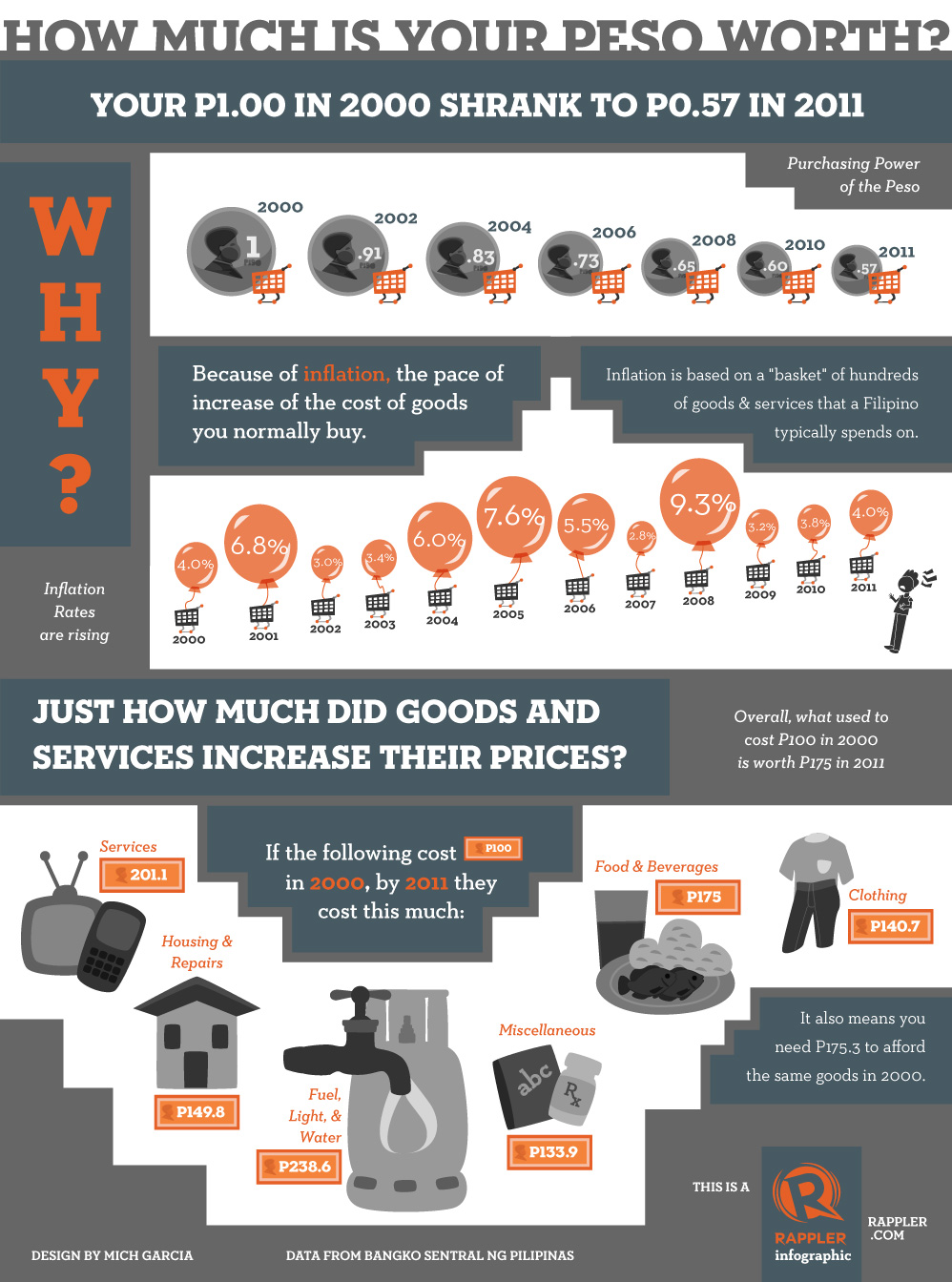

That is the very reason why we need to invest – because of

inflation. That is, the rate at which

prices of services and goods go up. Now,

that makes me think how about 10-15 years from now, how much will my 1,000

pesos be only able to buy?

You may also wonder why is it that every month you end with

budget deficit, or now saddled with debt or unable to save anything?

Maybe there are things on how money works that many of us may

not know.

Why is it that many of us don’t really notice inflation and

its direct effect on our lives and on our future?

Because maybe many of us were not taught on how to manage money

and our finances in general and we grow up thinking that landing a good job,

working hard and saving is the key to a successful and prosperous life.

The Keys towards Financial Freedom

There are ways on how to achieve financial security and

freedom. These ways are achieved through

financial education which anyone can easily learn and practice if he is really

resolved to be successful and let go a life of debt, insufficiency and a future

without security.

Let me enumerate them the 4 Simple Steps:

1. Increase

Cash Flow

·

Earn Additional Income

·

Manage Expenses

2. Manage

Debt

·

Consolidate Debt

·

Eliminate Debt

3. Create

Emergency Fund

·

Save three months income

·

Prepare for Medical Emergencies

Why Do We Need to Invest Again?

Many Filipinos work hard and save while many others still

work hard and just end up spending leaving nothing for the future. And looking at inflation, we are pretty sure

that goods and services will not get much cheaper in the future.

Others worked hard during their younger years yet end up bankrupt

or full of debts in their old age.

Others worked hard during their stronger days and when

sickness, or disability or God-forbid death comes to them, they leave their

families with nothing.

The key is we need to prepare for the future. Just like the ants, save during the sunny

days in order to be prepared for the rainy days.

We need to invest because we need to protect ourselves

from inflation and because we need to prepare for our future and that of our

family.

If we only save, we end up at the wrong side of the fence

because you will actually

even lose some value of your money as every year your interest income from your

savings is just 1%, the inflation rate (rate of increase in prices of

commodities and services) is about 2-4%, therefore the value of your money in

the bank lost 1-3%!

In Filipino language,

"lugi ka pa."

What we need to

do is invest in investment instruments that could give us at least 5% return a year.

Investment Options

There are many

ways on how to invest like in the stock market, mutual funds and of course

health care. And we need to start

early. Take a look that this chart of

how starting early in investing using the power of compounding interest will

benefit you.

In

the Stock Market for example, you can start start with just 5,000 and

can already buy shares of stocks of SM, Ayala, Jollibee, BPI, BDO,

Metrobank, PLDT among others. But the stock market is more technical

and risky than the mutual funds.

In

Mutual Funds, you can start investing with just 5,000 pesos and just

add up at least 1,000 per month. Your investment can have 19% CAGR (compunded annual growth rate) in 10 years (ref: philequity, as of 2/24/14).

On the other hand in the health care which is the most basic that everyone should have, you start with just about 2,700 monthly have a full health care protection, and at the same time insurance wherein disability and death are covered. It also has an investment which means whatever you have regularly put in this investment, it will grow from 5-10% per year just like a mutual fund. In short, unlike the regular HMO that only cover your health needs, this investment has an insurance and investment component that will give you and your family more security and financial stability.

Of course,

investing is based on your financial goals, financial needs, financial

objectives and strategies. And of course, these investment instruments have their own level of risks and returns too.

Do you want to

be more financially educated?

Do you want to

practice the 4 simple steps towards financially security?

Do you want to

learn more on how you can investing in stock market, health care or mutual

fund?

We will be happy

to teach those simple steps towards a more secured financial future and we will

be glad to assist you in making your investment choices.

Just fill up

the contact form below with your name, message and contact number and we will

also be sending you a FREE copy of “3 Ways to Start Investing" and a FREE Ebook

of Bo Sanchez’s “My Maid Invests in the Stock Market and Why You Should Too.”

I am interested and wants a Free Copy of "My Maid Invest in the Stock Market and Why You Should Too" and the "3 Ways to Start Investing" guide.

Simply Fill Up The Form Below Now

Powered by 123ContactForm | Report abuse |

No comments:

Post a Comment